Retirement – it’s a time to kick back, relax, and enjoy the rest of your golden years, right?

Well, sort of.

Yes, it’s a time for leisure and well-earned relaxation…

AND it’s also a time to reinvent yourself and dig into your new identity and retirement purpose.

Otherwise, you run the risk of some unwanted retirement anxiety.

After all, going from a totally structured lifestyle to a completely unstructured one is a big transition. Throw in a significant identity shift and it’s a shock to anyone’s system.

As for your credit score – to support your new endeavors during this new life phase, it’s also important to have a strong financial foundation that supports your retirement lifestyle – and your credit score has an essential role in your financial security.

Table of Contents hide

1Should You Worry About Your Credit Score in Retirement?

2Why Credit Scores Are Important in Retirement

2.1#1 Changing Locations

2.2#2 Easier to Take Loans

2.3#3 Credit Card Benefits

2.4#4 More Employment Options

34 Ways to Maintain Your Credit Score

3.1#1 Make On-Time Payments

3.3#3 Don’t Close Your Credit Accounts

3.4#4 Keep Your Credit Cards Active

4Maintain a Strong Credit Score in Retirement

Should You Worry About Your Credit Score in Retirement?

If you’re wondering if you should care about your credit score in retirement, the answer is YES.

While finance is just 1 of the 5 Rings of Retirement, it’s an equally significant one, and a major component that most retirees fail to factor in this area is their credit score.

Ideally, in retirement, it’s worth trying your best to ensure your credit score is strong – and if possible, doing so before you retire. Because it’s also essential to maintain your credit score even throughout retirement.

Beyond a stronger financial position, a solid credit score gives you more flexibility and more options – both financial and non-financial – during retirement.

Today, we’ll cover the various reasons why you should focus on your credit score in retirement and how to maintain it.

Why Credit Scores Are Important in Retirement

Credit scores are just as important in retirement as they are before you retire. After all, credit is a major part of our financial lives – and that includes during retirement.

Credit scores enable you to access finances that you can use to maintain or improve your current situation. Which can come in handy during retirement when you need funds to pursue new passions, travel the world, or enjoy your well-deserved leisure time.

Here are four top reasons why credit scores matter after retirement.

#1 Changing Locations

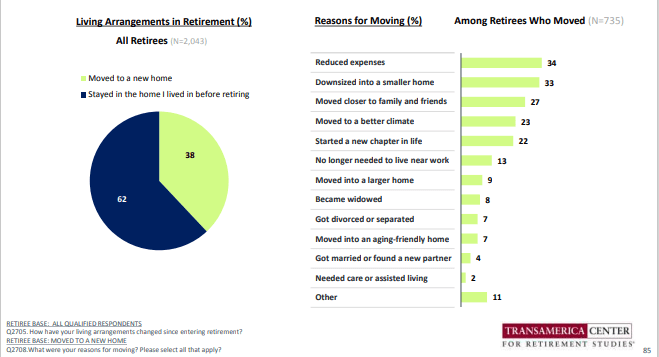

For some people, retirement means a change of scenery. According to the Transamerica Center for Retirement Studies, about 38% of people change locations after retirement.

Seeing as you no longer have full-time work obligations, you might want to move to a place you’ve always wanted to live.

Whether that means satisfying your sense of adventure and landing in one of the nine best countries to retire or finding a top retirement community in the US, if you want to buy a home in a new location, you most likely need to take out a new mortgage.

And to get the best rates, your credit score needs to be solid.

What if you don’t intend to purchase a new home?

Even if you simply move to a new retirement community (and reduce the stress of running a big house), while you don’t need a mortgage for this move, many communities typically run credit checks and require a security deposit before they can accept you.

Hence, if your credit score is not up to standard, you might not get accepted into these neighborhoods.

In a nutshell, a good credit score gives you more options in choosing where to live during retirement, regardless of whether you purchase or rent.

#2 Easier to Take Loans

Another reason why your credit score matters in retirement is there’s less friction if you need to take out a loan.

Sometimes loans are needed in case of emergency or unexpected health problems that may cause financial hardship. Unfortunately, health issues may increase as you get older.

According to a study, retirement may worsen mental or physical health.

That’s not to say it’s all doom and gloom as you age. In fact, if you’re familiar with our content, you know we’re huge advocates of living active, healthy, and engaged retirement lives, and our mission is to provide you with an arsenal of tools and helpful resources to get you there.

Yet it’s worth being proactive in anticipating any larger expenses to support your health and overall well-being during retirement.

For instance, if you or your partner suffer from an ailment that affects you or them physically, your home might need modifications and installations to make access easier.

Which means you may need to take a decent personal loan to complete these installations, and your credit score needs to be good.

On a more positive note, you may want to take out a loan to pursue a creative passion project, legacy project, or side business.

After all, creativity is especially important as you age. Which makes sense when you consider the average age of successful startup founders is 45 — and that’s just the average. There are plenty of examples of amazing late bloomers.

By the way, in case you’re in need, a great way to get a personal loan is CreditNinja. The CreditNinja online loan approval process is seamless, and you can receive your funds in no time.

The gist of it is – whether it’s to fund unwanted health expenses or an exciting passion project, a good credit score makes it easier to take out a loan.

#3 Credit Card Benefits

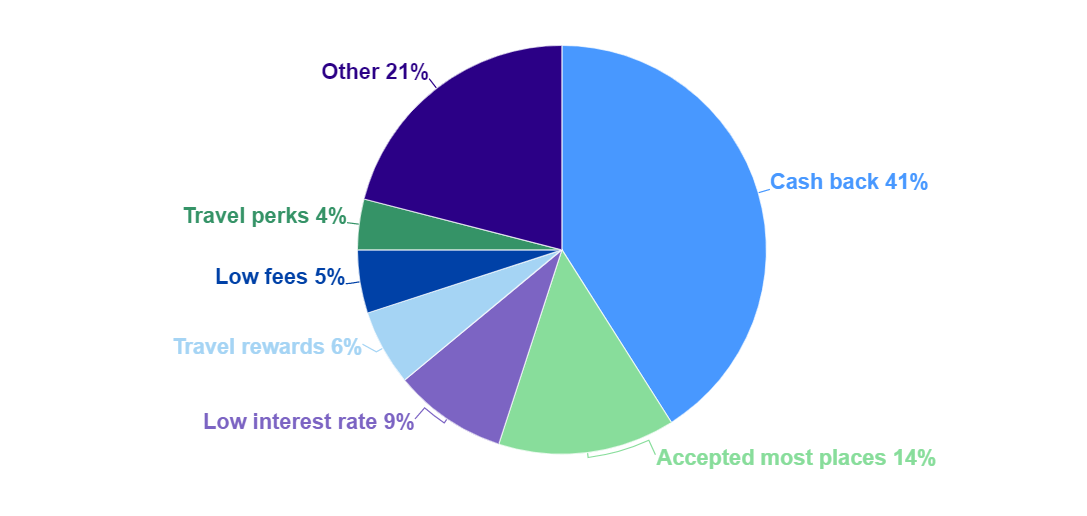

During retirement, you’ll probably be spending the money you saved while working, and a great way to reduce your spending and save is to opt for reward credit cards.

Several credit cards offer rewards such as cashbacks, air miles, travel perks, insurance coverage, and more. According to Bankrate, about 41% of American adults in a survey noted cashback credit cards as their favorite feature from these cards.

And here’s where your credit score comes in – to qualify for the best credit cards, your credit score needs to be in a good range.

Plus, the issuers of these credit cards typically run a credit report check whenever you apply for one.

Also known as “hard inquiry,” this credit check process might temporarily reduce your credit score. And if you have a standard credit score or above, the effects of this hard inquiry will be minimal.

All in all, a good credit score can lead to better credit card benefits, perks, and overall savings.

#4 More Employment Options

While retirement is a chance to relax without the stress of a work schedule, for most, being idle is not the way to go. And if you’re among the over 5 million people who had to retire early because of COVID-19, most of whom were baby boomers, you may still want to look for a retirement job.

Either way, you might be itching to get back to work to contribute your skills and talents and fuel your sense of purpose.

Or maybe you simply want to take up a job to ease the burden on your retirement savings or make a few extra bucks around the holidays.

Regardless of what your reason may be, a solid credit score might be what determines whether or not you get a particular job, as some employers tend to check your credit history before hiring you.

While not all employers do this, it is best to ensure your credit score is intact and your debt is minimal. With all these measures, you have enough options when picking a new job.

Now that you’re (hopefully) convinced your credit score is worth maintaining, here’s how to go about it.

4 Ways to Maintain Your Credit Score

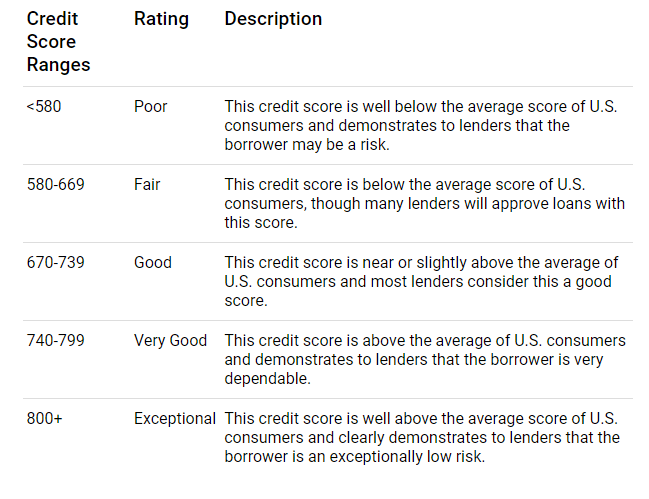

According to FICO®, a good credit score typically ranges from 670 to 800+. If you have this score at retirement, you’re good to go.

Retirement doesn’t directly affect your credit score, so no need to worry about that. But it is worth taking some steps to protect it from falling.

Here are four ways to maintain your credit score.

#1 Make On-Time Payments

Your payment history accounts for 35% of your score – so keep making timely payments even in retirement.

Fortunately, numerous credit monitoring businesses send reminders when you have a bill coming up, and these reminders can be quite helpful.

If your income after retirement reduces drastically making it difficult for you to make payments on time, budget accordingly so your score doesn’t suffer from late payments.

#2 Check Your Credit Score & History Regularly

Check your score from time to time to ensure it’s in good shape. If it’s not, then you can find ways to improve it.

Nerdwallet recommends checking your credit report about once a year.

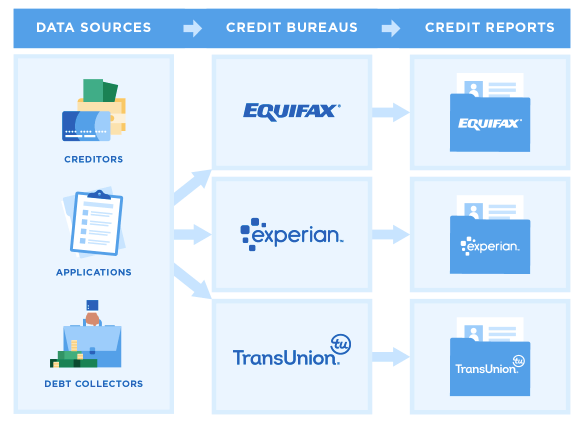

Nowadays, you don’t need to pay money to check your score and you can simply visit one of the many credit monitoring services on the internet, like Annual Credit Report or one of the three credit bureaus.

Also, another benefit of checking your credit report frequently is avoiding credit fraud and identity theft, which, sadly, older adults are more susceptible to.

In fact, in 2021, 92,371 older victims of fraud resulted in $1.7 billion in losses.

Hence, you must monitor your credit report and look out for any unusual activities. In some cases, you might find errors in your report, which you can immediately address as they could also affect your credit.

#3 Don’t Close Your Credit Accounts

Even if you’re over the age of retirement, it’s not a good idea to close your credit card accounts. This is because closing a credit card account can increase the credit card debt-to-limit ratio on your other cards.

If you cancel credit cards that you don’t use, your utilization ratio will likely increase, hurting your credit score.

On top of that, your credit score is influenced by the span of your credit history. And canceling an old account could result in a drop in points.

#4 Keep Your Credit Cards Active

If you reduced your spending in retirement, it’s still important to keep using your credit cards. Otherwise, you might encounter two undesirable situations:

- The issuer may terminate the card

- The issuer may erase it from your credit score for inactivity

Credit cards require 3-6 months of continuous activity to be included in your credit score.

Maintain a Strong Credit Score in Retirement

No matter what stage of life you’re in, your credit score is important. You need it for loans, mortgages, and other benefits.

Try and build a good score before you retire and maintain it during retirement.

In sum, a solid credit score in retirement allows you to more easily:

- Change locations – whether it’s for renting or purchasing a new place, a good credit score helps you land where you want

- Take out a loan – a solid credit score lets you take a loan more easily, whether it’s for large health, home, hobby, or business expenses

- Benefit from credit card perks – you can save some of your retirement budget with credit card benefits and programs

- Explore employment options – sometimes a good credit score gives you more employment opportunities

To maintain your credit score in retirement:

- Make payments on time

- Check your credit report at least once a year

- Keep your credit accounts open

- Keep your credit cards active

With a good credit score, accessing finances to achieve both your financial and non-financial goals in retirement becomes a smoother journey.

—

This article is sponsored by CreditNinja